Taking Care of Taxes for the Self Employed

Tips for first time self-employed filers

Working from home might provide certain conveniences, but don’t count a tax break among them.

The COVID-19 pandemic changed the way that Americans work, with many adopting a remote setup. Some businesses have pushed to return workers to the office, but many workers continue to work from home (WFH).

IRS ON HIRING BLITZ AS TAX RETURN BACKLOG SWELLS

But remote does not come with any added tax benefits, according to tax prep companies.

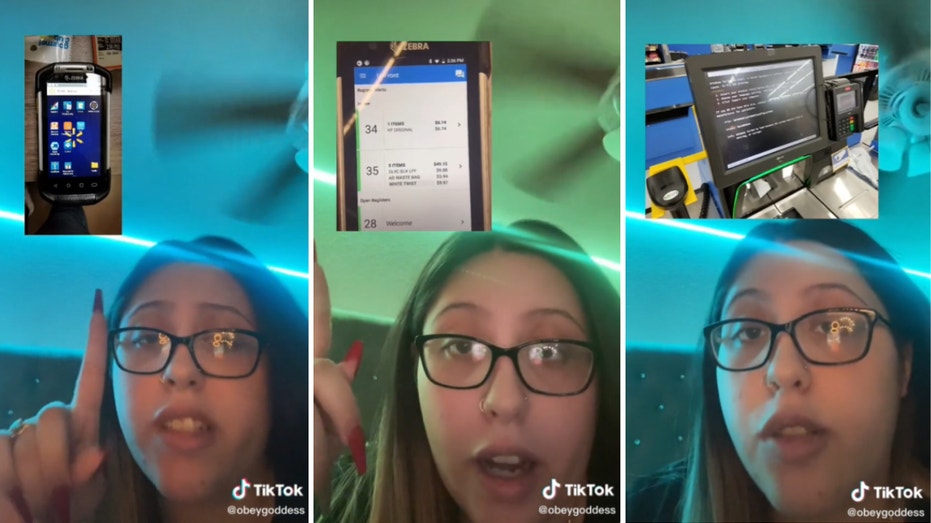

working from home concept | iStock An H&R Block spokesperson told FOX Business that "Taxpayers that are working from home as an employee will not be able to deduct any expenses related to their work. The Tax Cuts and Jobs Act of 2017 eliminated the deduction for unreimbursed employee expenses for tax years 2018-2025." Instead, taxpayers who are self-employed "may qualify for the home office deduction and any other business expenses that are ordinary and necessary to their business." Such deductions rely on setting aside an area "exclusively and regularly" for the business. WILL RISING GAS PRICES IMPACT RETURN TO WORK? The one area that remote employees must pay attention to is any reimbursements received from their employers: Mark Steber, a senior vice president and chief tax information officer at Jackson Hewitt, explained that reimbursement can count as taxable income, depending on an employer’s benefits setup. "What I have seen over the last year, absent a tax break … is a great deal more discussion and negotiation with your employer to say I am working from home, I have incurred these costs and these new, work-related expenses, how about some reimbursement," Steber explained. "But those are really reimbursements for out-of-pocket expenses, and unless you have an accountable business expense plan, that’s taxable income." Businessman discussing work on video call with team members "If you ask your boss for $5000 for a desk or multiple monitors, and they give you $5000, that’s taxable income," Steber added, calling it a "facts and circumstances" situation. "Now, there are rules for accountable plans … if you have an accountable plan where you submit receipts, and you’re reimbursed for those receipts and certainly not just given a wad of cash, you very well might be able to not declare that as taxable income." The landscape of WFH, self-employed businesses is booming thanks to what tax prep firm Intuit calls the "creator economy" – an industry that includes everyone from Instagram influencers to Twitch streamers and even OnlyFans talent. HOW TO OFFSET COLLEGE COSTS WITH EDUCATION TAX CREDITS A recent TurboTax survey found an increase of 207% in taxpayers claiming creator, streamer, influencer or related occupations from tax year 2018 to tax year 2020. Just over half of those individuals filed without a W-2 form, indicating that they rely on their creator occupation as the primary source of income. "We’re just trying to educate those people because they’re making money and they’re self-employed," Lisa Greene-Lewis, an Intuit CPA and TurboTax blog editor, told FOX Business. "They don’t realize now they’re making money, and on the flip side, they’re so much they can deduct and such unique deductions at that, like their camera equipment, all of it." Steber believes that the tax code will evolve to reflect the reality of the average American: If a bulk of workers remain remote the tax code may eventually account for it. GET FOX BUSINESS ON THE GO BY CLICKING HERE "That’s how our tax code has gotten to be the complex and yet fair way it is," he said. "What the taxes have been reflective of is the complicated nature of our society: Buy a new home, get a new home buyer credit; buy electric vehicles, they created an alternative fuel vehicle credit; working from home as a business, a home office deduction." "It’s certainly within the powers of our elected officials," he added, noting that is not in the current conversation. Source: Read Full Article